Growth Spurt at Intuit

- Share via

MOUNTAIN VIEW — While most of the high-tech industry hunkers down, financial software maker Intuit Corp. is muscling up.

In the last year, the company behind such popular software products as TurboTax, Quicken and QuickBooks has expanded its product line, spent $490 million on six acquisitions and built one of the industry’s most successful online subscription services.

The burst of activity for Mountain View-based Intuit follows Steve Bennett’s arrival as chief executive in January 2000.

With annual revenue of more than $1 billion, Intuit wasn’t exactly dozing. But Bennett, a former executive at hard-driving General Electric Co., spotted troubling signs of lethargy.

“I knew this was a company that should have been doing so much better,” Bennett said. “We decided to raise the bar and challenged everyone to start thinking in different ways.”

Besides pushing Intuit into new niches, Bennett has been jettisoning pieces of the business that either weren’t producing adequate returns or didn’t fit well with the company’s new direction.

Since Bennett’s arrival, Intuit has pruned $45 million in annual expenses from its Quicken software division, dumped its online insurance business and sold its mortgage loan division.

With Bennett applying the pressure, Intuit keeps raising its financial projections while most other high-tech companies lower expectations.

In its fiscal year ended in July, Intuit earned $140 million on sales of $1.36 billion. If not for charges related to its shopping spree and other items unrelated to its ongoing business, Intuit said its profit for the last year would have been $211 million, a 30% improvement from the previous year.

Bennett believes that Intuit’s revenue could climb by as much as 32% to $1.8 billion in the company’s new fiscal year while profit could rise by as much as 40%.

Intuit’s bright outlook amid Silicon Valley’s gloom reflects largely reliable demand for the company’s tax and accounting products.

Regardless of whether the economy is slumping, “people always have to do their taxes and keep their books,” Bennett said.

Intuit’s steady performance is turning the company into a haven for high-tech investors seeking shelter from stock market turbulence. The company’s shares Friday fell $1.94 to $45.81 on Nasdaq, well off its early 2000 peak of $90, but Intuit’s shares remain up 7% for the year.

Intuit figures the Internal Revenue Service’s heavy promotion of electronic filing will contribute to its growth. The company’s tax business generated $573 million in sales during its latest fiscal year, a 26% increase from the previous year.

Barring radical tax reforms, about half of the 36 million taxpayers still filing their returns manually will turn to TurboTax or other tax-filing programs such as H&R; Block Inc.’s TaxCut in the next few years, predicted industry analyst Adam Holt of J.P. Morgan H&Q.;

The 19-year-old company is building on the popularity of its TurboTax software with an online edition that is rapidly winning over converts to electronic tax returns. In the last year, 2.1 million customers--an 80% increase from the previous year--paid fees of as much as $39.95 to file their taxes over the Web.

Intuit attracted the online growth without cannibalizing the sales of its desktop version of TurboTax, of which the firm sold 5.5 million units, up from 5.2 million the previous year.

With tax trends working in its favor, Intuit is devoting more attention to the $18-billion market for small-business software--a segment also being eyed by Microsoft Corp. and Oracle Corp.

Microsoft last year paid $1.1 billion to buy small-business specialist Great Plains Software, and Oracle has been selling an online service aimed at small businesses since last summer.

Neither of the software giants, however, have made significant inroads into Intuit’s small-business specialties. Bennett hopes to keep them at bay by building on the popularity of Intuit’s QuickBooks products.

Intuit recently introduced a more sophisticated version of QuickBooks, priced at $2,500 to $3,500, designed for small businesses as their payrolls expand beyond 25 employees.

Bennett is counting on this next chapter in QuickBooks to retain longtime customers such as Brett Wickard, who needed more advanced software to help him run his Portland, Maine-based music store chain.

With his Bull Moose Music chain expanding to 74 employees in nine stores, Wickard reluctantly was considering switching to a Great Plains product until Intuit showed him the expanded version of QuickBooks. He happily upgraded.

“We really didn’t want to switch,” Wickard said. “It would have been a nightmare.”

If Intuit is able to sell the deluxe edition of QuickBooks to just 5% of its 275,000 small-business users with more than 25 workers, it will generate $41 million in revenue, Holt said.

Holt is bullish on Intuit, with a $57 price target on the stock.

Intuit also is introducing more industry-specific products and rolling out new services, such as payroll processing.

Since last November, Intuit has bought OMware Inc., the Flagship Group, CBS Employer Services Inc., Management Reports Inc., Eclipse Inc. and Blue Ocean Software for a total of $490 million in cash and stock. All are specialty software makers except CBS Employer, which provides payroll services.

“These are not fixer-uppers,” Bennett said. “These are already strong businesses that we are turbocharging with our brand. We want to become ubiquitous.”

More to Read

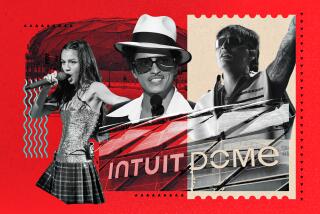

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.