Irvine Co. Expected to Proceed With REIT Pricing : Offering: Despite declining market conditions, the price could be set Monday, allowing the shares to trade Tuesday, analysts say.

IRVINE — Irvine Co.’s offering of shares in a new real estate investment trust could be priced as early as Monday, despite a recent decline in the REIT market that may affect the deal, analysts said this week.

Though underwriters could decide to postpone the pricing if REITs continue to decline and market conditions deteriorate, Irvine Co. officials expect to proceed sometime next week, sources familiar with the offering said.

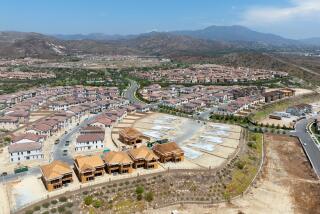

The company, which is Orange County’s largest landowner, has said it expects to raise $200 million through the offering of stakes in apartment properties. If the price is set late Monday, the REIT could begin trading publicly on Tuesday, sources said.

A REIT allows investors to buy shares in a company that manages a portfolio of real estate that can range from shopping centers and offices to apartment complexes to make a profit for the stockholders.

The entire REIT market, which closely follows the bond market, has been unsettled this week, with some REIT prices declining dramatically because of concerns that interest rates will rise, analysts said.

In fact, in the past three weeks the market has seen at least a 10% drop in REIT prices, said Craig Leupold, an analyst with Green Street Advisors, a Newport Beach firm that analyzes real estate securities. Three REITs that went public in the past week “have all been hurt. They’re trading very sloppy,” he said.

That can’t help but affect pricing of Irvine Co.’s REIT, which estimated its pricing levels weeks ago when the market was stronger, Leupold said.

The REIT, called Irvine Apartment Communities Inc., plans to raise $200 million through its initial public offering by selling investors 10.6 million common shares priced at $19.50 to $21.50 apiece, according to Securities and Exchange Commission filings. The REIT includes 43 apartment communities with a total of 11,334 units.

In a recent SEC filing, the company reported that, for the nine months ended Sept. 30, its cash flow improved 6% to $54 million from the same period a year earlier, and rental income increased 3.5% to $92 million.

Despite those improvements, the REIT deal could take a hit on Wall Street.

“Because we’ve seen prices come down, a REIT like the Irvine Co.’s . . . will have trouble getting the price they wanted,” said Jill Holup, a portfolio manager at Liquidity Fund, an Emeryville, Calif., firm that specializes in real estate securities.

Holup, who said the new REIT is expected to be priced Monday or Tuesday, noted lingering investor concerns about Southern California real estate.

“If this deal were in Atlanta or Austin, (Tex.,) where they are seeing large rent increases, it would be much more attractive to investors,” she said.

Holup said analysts initially had some misgivings about the potential for conflict of interest--specifically, whether the REIT would be truly separate from the Irvine Co. However, those concerns were addressed in recent filings with the SEC, she said.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.