Man Charged With Bilking Poor, Elderly Out of Homes : Court: A Rancho Palos Verdes realty investor faces 32 felony counts. He is accused of using various companies and complicated transactions to dupe unsophisticated victims.

- Share via

A young Rancho Palos Verdes real estate investor who has been the subject of at least 175 civil lawsuits has been charged with 32 felony counts alleging that he cheated the poor and elderly out of their homes.

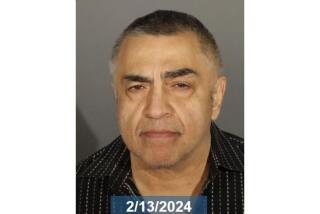

Kevin S. Merritt, 31, appeared in Los Angeles Municipal Court Monday and was released on $400,000 bail. He is expected to be arraigned within a few weeks. Surrounded by a retinue of attorneys, family and associates, he declined comment.

“There are an average of 80 or 90 (civil) cases filed against (Merritt) every year,” said Deputy Dist. Atty. Robert M. Youngdahl. “As a result of the news media articles, we began to get calls on this man right and left. . . . Now we have filed (criminal charges) on 19 of those cases.”

Among the charges filed against Merritt were grand theft, recording a false or forged document and fraud.

Merritt uses a network of companies, among them the Univest Home Loan Inc., to transfer title to properties owned by poor, sick or unsophisticated homeowners, according to Youngdahl and public interest attorneys representing Merritt’s alleged victims. In many cases, they said, homeowners had no idea that papers they had signed put their homes in jeopardy.

Merritt sought out homes worth as little as $85,000 that were either clear of debt or had high equity, Youngdahl alleged. Typically, he added, one of Merritt’s entities would loan the homeowner money and reassure him verbally that their homes were not at stake. Not until the homeowner received an eviction notice would he realize something was wrong.

In one case, a Merritt entity foreclosed on a South-Central Los Angeles church, its pastor’s home and the home of the pastor’s mother and sister, Youngdahl said.

In that case, the small church of about 100 congregants, the Greater Evangelist Temple Church of God in Christ, sought a loan of $60,000 in 1985 to move the church from a temporary location in the path of Century Freeway construction. The pastor, Albert Johnson Jr., sought a loan from Merritt after the church was turned down by other lenders.

Johnson’s parents, Albert and Thelma, and his sister and brother-in-law, Doris and Larry Greene, were members of the church and agreed to be co-signers for the loan.

“Kevin just seemed like a nice, young man who told us this was what you did, that he needed somebody to verify that they knew the pastor and the church,” said Thelma Johnson, 69. She did not know, she said, that she was signing loan papers for $22,000.

“That don’t mean you’re not taking our house or nothin’?” she said she asked Merritt.

He reassured her, she said, that her house was “not involved.”

On another occasion, she said, he reassured her that “even if I have to pay for it myself,” she and her husband would not lose their home because they were “older people.”

Four years and several transactions later, Johnson said, the church lost its property, her pastor son lost his home, and then she and her husband were handed an eviction notice. Shortly thereafter, her daughter and son-in-law found out when they tried to sell their home that one of Merritt’s companies had blocked title.

At one point, according to the family’s attorney, Lynn T. Jackson of Community Legal Services, the $60,000 loan to the church had ballooned to $210,000 and included a $24,000 loan “fee.”

“It is a terribly complicated series of transactions involving about 10 shell companies in which one company sells to another company,” Jackson said. “It is complicated even for people who understand real estate, let alone unsophisticated people like the Johnsons.”

But Thelma Johnson said what concerns her most about the deal was that her husband Albert, now 75, had worked to pay off the mortgage on their home purchased in the late 1950s. He was in an intensive care ward in a hospital on Monday, she said. “The last thing he told me before he went in was, ‘Don’t let them take our home,’ ” she said.

Youngdahl said many of Merritt’s alleged victims would call local police to report Merritt, only to be told it was a civil matter and to consult an attorney. However, he said, many victims could not afford attorneys. Some found public interest attorneys--and eventually news stories were written about Merritt.

Ken Babcock, directing attorney of poverty law programs at Public Counsel, a public interest law firm sponsored by the Los Angeles County and Beverly Hills bar associations, said that firm has about half a dozen cases involving Merritt that have been placed with private attorneys and one larger case against Merritt alleging civil racketeering.

“Kevin Merritt is the principal actor in a very large fraud scam that is in essence trying to steal the equity and title to homes of poor and often elderly homeowners in South-Central Los Angeles,” Babcock alleged.

In 1989, he said, employees of Merritt’s gave an 85-year-old Watts man named Roland Henry papers to sign that he believed were for a home loan.

“But they slipped in a grant deed for him to sign,” Babock said. “And he signed. Here was an 85-year-old man from east Texas. He had one eye, one leg and a sixth-grade education. He never would have signed if he had known he was signing his home away.”

Attorneys were able to regain Henry’s home through various court actions, Babcock said, and Henry died at his home in February.

More to Read

Sign up for Essential California

The most important California stories and recommendations in your inbox every morning.

You may occasionally receive promotional content from the Los Angeles Times.