Stater Bros. Feud a Clash of Opposites : Principals in Fight for Control Are a Study in Contrasts

Just beneath the surface of the corporate battle for control of Stater Bros., a chain of 94 Southern California supermarkets based in Colton, is a bitter personal feud between two men with vastly different personalities and backgrounds.

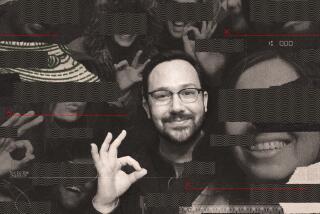

In one corner is Jack Brown, a gregarious, 46-year-old native of San Bernardino who started out as a box boy at a neighborhood store and became president and chief executive of Stater Bros., one of the Inland Empireâs largest private employers.

In the other is Bernard R. Garrett, a low-key, 59-year-old investor who became chairman after an investor group bought Stater Bros. for $46 million from Petrolane, a Long Beach petroleum services firm, in 1983.

The feud surfaced publicly last month, when Garrett announced that Stater directors had suspended Brown and filed suit against him, alleging that he had manipulated the chainâs profit figures to permit him and his supporters to buy Stater stock below fair market value. Brown has vehemently denied the Garrett charges and, with the assistance of many Stater employees loyal to him, has launched a proxy fight to take control of the board.

Both men are predicting victory at the annual shareholders meeting scheduled for April 28.

JACK BROWN

âYou never hunt a grizzly bear in his home woods,â said Brown, a heavyset man with an easy smile, âand Garrett done took on the grizzly bear of the Inland Empire.â

Those were tough words for a man who was suspended as Staterâs president and chief executive Feb. 10 and named in a $30-million lawsuit which alleges that he manipulated Stater Bros. profit figures just before it made an initial stock offering last November.

The suit alleges that Brown tried to reduce the initial price level of the companyâs stock, allowing him to buy large numbers of shares at reduced prices.

But for the last several weeks, Brown has been âworking 12 hours a day, seven days a weekâ on a plan that could win back his job, defeat managementâs slate at the annual meeting and have the lawsuit dropped in one fell swoop.

The plan draws strength from the support of many friends Brown has within the company and among shareholders who reside in the San Bernardino area and know him as a civic leader.

In an unusual move, even the San Bernardino County board of supervisors joined the fray by adopting a resolution in support of the management team headed by Brown. The supervisors expressed concern about Garrettâs ability to run one of the countyâs largest private employers.

In the proxy fight, Brown said, âGarrett canât fight his way out of a wet grocery bag.â

Confident of Winning

Brown is so sure of his ability to defeat Garrett that âIâve already booked appointments for (the day after the annual meeting),â he said. âIâll be back in my offiCe immediately after the meeting.â

Many rank-and-file employees adore him, largely because of the âfamily atmosphereâ they say he helped instill since joining the company five years ago. Many employees credit Brown for starting company picnics and incentive programs in recent years.

On Feb. 16, a group of about 200 warehouse workers and truck drivers and their families held a support rally near the companyâs Colton headquarters.

Wearing T-shirts emblazoned with a picture of Brownâs head on a muscular, gun-toting torso and a caption that read âFirst Blood: Part 3--Brownbo--An American Tradition,â they chanted âBring Brown Back.â

One of those in attendance was Ron Heiman, a 39-year-old San Bernardino truck driver who has been with the company for 18 years.

âJackâs like a father figure to us,â Heiman said. âHe comes out and talks to us in the yard, listens to our problems. . . . At functions, he wears Levis, cowboy boots and western shirts like we do.â

And many of his friends from the local community have offered to buy stock to help Brown win.

Important Support

âIâve offered to join his company as a stockholder,â said William Leonard, 63, a real estate investor regarded as an important force in the Inland Empireâs business and political realms.

âHeâs a native son who got what he has the hard way--dog-gone diligent work,â Leonard said.

Brown will need more than gushing praise, however, to have his nominees elected to the board at the annual meeting.

They include John C. Wallace of Long Beach, a private investor and consultant to Petrolane; Lawrence Carr of Alaska, president and 43% owner of privately held Carr Gottstein Co., which operates Alaskan food, drug, advertising and real estate businesses; and Martin A. Matich of Colton, president of Matich Corp., a privately held engineering contractor, and major Republican fund-raiser.

Brownâs ability to call on movers and shakers such as Leonard and Matich is rooted in his ties to the community. Brown was 13 years old when he was hired to work as a box boy at Berkâs Market Spot in San Bernardino. As a reminder of his start in the grocery business 34 years ago, he still carries his first box cutter in his briefcase.

Brown married Donna Sage, daughter of Milton Sage, who owned the local Sageâs supermarket chain. During the 14 years he was employed at the Sage company, Brown became vice president of sales and marketing.

He later served as corporate vice president for Marsh Supermarkets Inc. of Yorktown, Ind.; president of Pantry Food Markets in Pasadena, and president of Hinky Dinky Supermarkets in Omaha, Neb..

Named to Top Post

In 1981, he was named president and chief executive of Stater Bros. (Ironically, after Brown was suspended the company named Joe S. Burkle, Brownâs predecessor, to the posts of executive vice president and vice chairman and chief operating officer of the supermarket subsidiary.) Two years later, Brown and a group of private investors which included Garrett bought the grocery chain from Petrolane in a leveraged buy-out. (In a such a deal, a companyâs assets are used as collateral to help finance the acquisition.)

Brown contends that his problems with Garrett began in mid-October, 1985, when he learned that Garrett had previously been involved with at least three companies that later filed for bankruptcy protection.

Their divorce seemed imminent when, at a monthly board meeting held Feb. 5, he opposed managementâs slate of directors for election at the annual shareholders meeting. Brown said he decided that the slate of nominees âlooked like it was hand-pickedâ by Garrett and was not âindependent.â

Five days later, Brown and another director, Bruce Varner, were called to a special meeting of the board. Three minutes into the meeting, âbang, I was suspended,â Brown said.

âGarrett said, âI have had charges brought to me by unnamed parties that you have manipulated inventories of the company,â â Brown recalled. âHe said, âbased on those allegations we have filed a $30-million lawsuit against you. And based on that fact, I have asked the board to suspend you.â â

Brown Fought Back

Brown and his supporters fought back in interviews and employee meetings by disclosing that Garrett had been affiliated with at least three companies that had filed bankruptcy petitions and that the future of Stater Bros. was therefore in doubt.

Brown has also threatened publicly to file a lawsuit against Garrett for what he called âlibelous and slanderousâ charges made in Garrettâs lawsuit.

âWeâre not talking about arm-wrestling over a 7--Eleven store,â Brown said. âThese are big potatoes.â

BERNARD GARRETT

âHe started it,â said Garrett, a tall, balding man with a raspy New York accent. âWeâre peaceful businessmen.â

Garrett described himself in an interview at Stater Bros. headquarters in Colton as a âprivate person, an investorâ who enjoys working behind the scenes.

But Garrett has a fighting side, too.

âMr. Brown is in for a surprise,â Garrett said. âMany of the people he feels are in the bag are not in a Brown bag.â

Still, Garrett has kept such a low profile that many employees say they donât know what he looks like and that has become an issue in the fight for control of the company. Garrett is working hard to change that.

Acknowledging that Brown âis great on public relations,â Garrett has started meeting with company executives and union representatives in hopes of mustering loyalty and improving relations.

âWe are going out and visiting with people,â Garrett said. âI have been complimented on my high visibility in the last few weeks.â

Meets With Teamsters

Garrett has also held fence-mending sessions with representatives of Teamsters Local 63, a bastion of Brown supporters.

For their part, union workers fondly recall that Brown prevented a walkout at Stater Bros. by agreeing to abide by whatever contracts came out of union negotiations during the supermarket industry strike last November.

âThis is a classic example of someone who does a fine job with people (versus) a financial backer,â said Norman Holman, coordinator of the unionâs office in Rialto. âBrown is young and aggressive. He brought a manâs word and handshake back to corporate operations.â

In his recent flurry of meetings with employees, Garrett has emphasized his commitment to the company and has tried to clarify concerns about his admittedly litigious past and connections with companies that have filed for bankruptcy.

âI have several lawsuits pending against me involving business matters,â Garrett said. âWe have (filed) countersuits.â

On March 7, Garrett filed a $3-million defamation lawsuit against Brown over statements made in newspaper articles about him. He said the lawsuit was filed to protect his reputation.

Fired by His Brother

Schooled as an electrical engineer, Garrettâs first corporate fight occurred in 1978, when he was fired as president of Instrument Systems Corp., a Jericho, N.Y.-based maker of electronic systems, by his brother Edward, who had founded the company.

In a suit filed at the time of their falling out, Bernard Garrett alleged that his brotherâs actions may have been the result of mental and physical problems. Edward Garrett, now deceased, told the New York Times in a 1979 interview that his brother had threatened his life. Bernard Garrett denied that allegation.

Before he fired him, Edward had been hospitalized for a heart ailment, Bernard Garrett said. âWhen he came out of it, he was ready for the funny farm,â said Garrett, who sold his half of the company in 1979.

Bernard Garrettâs wife, Rita, died in 1978, leaving her assets in trust to their two children. A year later, Garrett formed Hamsphire National Inc., a management company with investments in real estate properties in California and the Southeast.

From 1980 to 1983, federal bankruptcy petitions were filed by or against three groups of companies in which Garrett or his family had acquired a controlling interest in leveraged buy-out transactions, according to the Stater Bros. prospectus dated last November, 1985.

âNo allegations or claims were made against Mr. Garrett in connection with any actions or proceedings relating to such bankruptcies,â the prospectus said.

Trust Controls Firm

In 1983, Garrett joined the partnership that bought Stater Bros. from Petrolane in an arrangement that gave his childrenâs trust a controlling interest in the company.

Garrett said he became interested in the Inland Empire in 1980, after he had conducted a series of research studies into the demographics and future growth projections in the area. In 1982, Garrett said he was advised of the pending sale of Stater Bros. by Petrolane. After doing his research, Garrett said he decided to arrange the purchase of the company by Hampshire National.

As part of the deal, La Cadena, an investor group headed by Brown, was permitted to participate. Using mostly borrowed money, the acquisition was completed. In a simultaneous initial public offering, Garrett acquired 51% of Stater Bros. and the Brown group 49%.

The way Garrett tells it, his problems with Brown began in December, when âour (profits) were improving dramaticallyâ and âwe saw La Cadena buying shares.â

Garrett said he launched an internal investigation the same month based on his suspicions of âinsider tradingâ and âindicationsâ that a possible scheme to take over the company was under way. The lawsuit against Brown claims that he purposely understated the profitability of the supermarket chain in order to hold down the initial value of its stock. The shares rose sharply after they were issued, particularly after the company reported higher earnings for the period ended Dec. 19, 1985.

Approved Large Bonuses

Even though he launched the investigation about the same time, Garrett said he approved a large bonus for Brown and other top executives based on company profits as of Sept. 29, 1985.

âWe were contractually obligated to pay the bonus,â Garrett said. âI regret having rewarded him a bonus in light of the information that came out.â

The partnership ended Feb. 10, when the board voted 6 to 2 to suspend Brown on grounds that there was reason to believe that he had manipulated profit figures.

Brown subsequently issued a lengthy rebuttal to those allegations, claiming that any âmanipulationsâ were actually accepted accounting practices in the supermarket industry.

Brownâs office was placed under 24-hour guard to protect company records and an outside public relations firm was hired to handle inquiries.

These and other actions âare costing the company, but we donât know at this point what the total costs will be,â Garrett said. âWe think we are preserving the assets of the company.â

Garrett said regardless of how the shareholders vote, âit seems unlikelyâ that he and Brown will work together again.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production â and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.